I think you'll make money," she told CNBC's Squawk Box last week. "The stock won't make you money in the first half of the year, but in the second half. 15, Mahaney said he sees value in the stock at its current levels and a "highly attractive reward-risk framework for investors with a 9-12 month outlook." A similar time horizon for a rebound in the stock is given by Hightower Advisors Chief Investment Strategist Stephanie Link. Evercore's head of internet research, Mark Mahaney, also believes that Meta is working to solve its problems and said the current issues are "priced into FB shares." In a note on Feb. O'Leary said Meta is addressing investor concerns and trying address its issues with TikTok and regulatory changes. Investor and venture capitalist, Kevin O'Leary, believes "now is the time to own the stock." "This is the bottom, this is where you want to accumulate," he told the CNBC's Halftime Report on Feb.

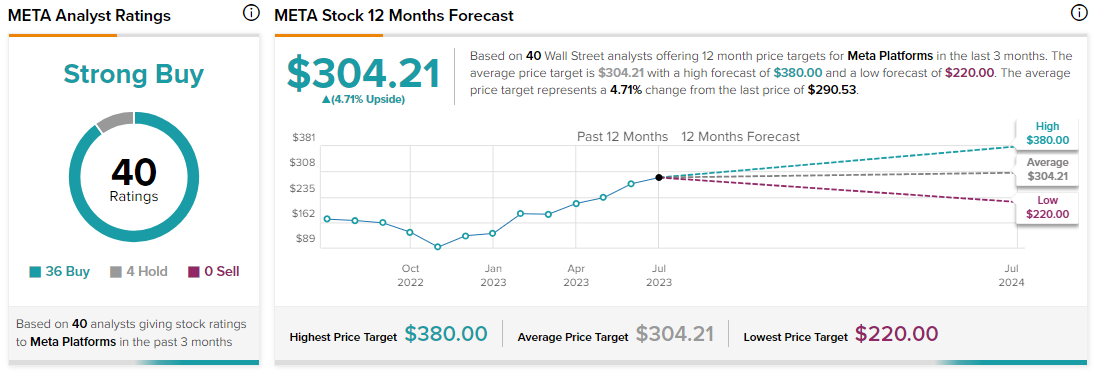

Other analysts are significantly more bullish on the stock in the immediate term. He added that the stock is the "cheapest it has ever been, cheaper than all of the big tech stocks right now." Similarly, Ygal Arounian from Wedbush Securities told CNBC on Thursday that Meta "has not passed its peak and on a valuation basis the stock looks pretty attractive right now." However, in a note earlier this month, he expressed concerns that Meta's problems could "get worse before they get better," and downgraded the company to neutral, with a $270 price target. "The stock is likely to bounce around the bottom for a little bit until the company can prove they are fixing things, which may take a couple of quarters," Fitzgerald said during a phone interview with CNBC on Thursday. Wells Fargo Senior Equity Research Analyst Brian Fitzgerald, who issued a $350 price target on Meta stock recently, is also confident the tech giant will successfully complete its pivot towards the metaverse - but it may take some time. It reflects the fact that "Meta has historically managed these transitions before and come out stronger," Patterson wrote in a note on Feb.

He added that the "payoff potential for Meta is really good provided they can execute its plans to grow the Metaverse." The firm's revised price target of $280 on Meta stock represents an upside of over 35% from Friday's close. "Meta still offers attractive returns right now to investors and there isn't much downside from these levels," Patterson said in a phone interview with CNBC on Thursday. Closing at $206.16 on Friday - a 52 week low - a number of Wall Street analysts, such as KeyBanc Capital Market's Justin Patterson, think now is the time to buy. 3, with concerns about growing competition from TikTok and privacy changes wiping $200 million off Meta's market cap. It came after the company reported worse-than-expected earnings on Feb. All FAANG stocks are trading in the red year-to-date, but Meta's plunge is the steepest. But many Wall Street analysts are forecasting a strong upward trend in the coming months. Personal Loans for 670 Credit Score or Lowerĭown over 38% so far in 2022, Meta - formerly Facebook - is the worst performing FAANG stock of the year. Personal Loans for 580 Credit Score or Lower Best Debt Consolidation Loans for Bad Credit

0 kommentar(er)

0 kommentar(er)